All published articles of this journal are available on ScienceDirect.

Government-Backed Loans Program and Its Role in Supporting Small-Scale Farmers in Jordan

Abstract

Introduction

The specific relevance and effectiveness of various financing avenues across different farmer groups largely remain unclear. Notably, the evidence on the Agricultural Credit Corporation, widely regarded as the core government-backed organization in Jordan, remains largely narrative. The same applies to any other microfinance institution, if it exists. There is little clarity on the conditions that enable or limit these organizations in effectively serving small-scale farmers. This research explores the financial needs and demands of small-scale farmers based on their agricultural activities. It also examines the impact of government-backed loans on small-scale farmers. Finally, it discusses best practices for lending organizations and highlights the role of government in implementing agricultural lending operations in Jordan.

Methodology

Based on the information gathered through analysis of relevant literature, comprehensive interviews with recognized experts in the field, and focus group discussions. This case study demonstrates how the Agricultural Credit Corporation has supported and developed the agricultural sector in Jordan.

Results

The Agricultural Credit Corporation has an important role in the agricultural finance sector, expanding its influence and maintaining its commitment to comprehensive agricultural and rural development by providing financing services that meet farmers’ needs efficiently and effectively. Findings show that government agricultural loans have a significant impact on small-scale farmers. The results indicated that higher levels of schooling, greater farming experience, larger landholdings, better transportation access, and more frequent interactions with extension services positively and markedly influence the likelihood of seeking formal financial assistance.

Discussion

The results indicate that financial support programs, coupled with stronger institutions and better credit access, are crucial to improving rural livelihoods, food security, and sustainable agriculture. Strengthening the agricultural credit system through coherent policies and effective governance could be pivotal for advancing financial inclusion and ensuring the sustainable development of Jordan’s agricultural sector.

Conclusion

Government policies and financial institutions’ lending criteria may change after the study period, potentially affecting the long-term applicability of the findings. This study adds to the body of knowledge on agricultural finance by highlighting the effectiveness and limitations of government-backed loans in a developing economy with semi-arid farming conditions.

1. INTRODUCTION

The agriculture sector in Jordan is among the most competitive industries, contributing 6% to the country’s Gross Domestic Product (GDP) [1]. However, when factoring in the indirect contributions of the food sector, agriculture’s share of GDP can rise to between 25% and 30%. In addition, the agriculture and food industries together provide employment for roughly 20% to 25% of the nation’s active workforce [2]. The agriculture sector plays an important socio-economic role, especially in rural areas, where it serves as a primary livelihood for local communities. Jordan’s diverse climatic and geographic zones give the country a unique competitive edge in producing and exporting fresh fruits and vegetables. However, water scarcity poses a critical challenge to its food system. Classified among the most water-deprived nations in the world, Jordan’s annual renewable water resources amount to just 100 cubic meters per person [3]. The agriculture sector is responsible for roughly half of the country’s water consumption, which has been particularly hard hit by limited water availability. Securing adequate freshwater resources-both surface and groundwater-remains one of the sector’s most pressing concerns. Beyond water scarcity, the agriculture sector in Jordan faces several interconnected challenges. These are the rapid depletion of highland aquifers due to overuse, inefficient and wasteful irrigation practices, soil degradation, climate change impacts, advancing desertification, loss of fertile topsoil, saltwater intrusion into freshwater reserves, rising crop water requirements, and the gradual exhaustion of water sources for irrigation [4]. Jordan’s cultivated land covers approximately 221,000 hectares, of which about 141,000 hectares are rain-fed. These are primarily planted with olives, cereals (wheat and barley), and fruit trees (citrus, grapes, bananas, date palms, stone fruits, pomegranates, figs, apples, and strawberries). The remaining 80,000 hectares are irrigated, mainly producing vegetables (tomato, potato, cucumber, beans, onion, eggplant, squash, and leafy greens) and fruit trees [5]. In the livestock sector, the total number of sheep, goats, and cows amounted to 3,000,000, 765,000, and 78,000, respectively [5]. The scarcity of cultivable land has led to low domestic agricultural output and a heavy reliance on imported food, posing a major challenge to Jordan’s agricultural sector. Jordan was able to achieve varying levels of self-sufficiency across different commodities. For instance, self-sufficiency stands at 26% for red meat, 80% for poultry, 100% for cow’s milk, 89% for fruits including olives, 133% for vegetables, and 100% for table eggs [4]. Jordan’s agricultural sector is characterized by a large proportion of small-scale farms, which are a vital component of the country’s agriculture and play a significant role in sustaining rural livelihoods. In 2017, the total number of agricultural holdings was approximately 107,700, of which over 88% covered less than 3 hectares. For more than 16% of farming households in Jordan, agriculture remains the primary source of income [5]. To a remarkable degree, in Jordan, the situation of small-scale farmers is shaped by farm size, production systems, land tenure, and crop types. Key challenges include limited capacity to adopt modern practices, high indebtedness, land fragmentation, restricted market access, and declining export opportunities due to regional political instability. The scarcity of responsive extension and rural advisory services, coupled with the absence of reliable market information systems, weakens farmers’ bargaining power and market participation. These constraints heighten vulnerability to external shocks, reduce productivity, and limit profitability. Small-scale farmers largely operate at the bottom of the value chain, capturing minimal value due to information asymmetry, weak collective action, and poor market integration. Limited assets and low productivity further restrict their access to finance, as their activities are often deemed high-risk and difficult to monitor [6]. The agriculture sector in Jordan operates under a loan-pricing system that adjusts based on the risk associated with specific crops, locations, and financial products. In some situations, this results in more favorable terms for certain farmer groups, crop types, or regions. In others, it leads to steeper borrowing costs due to heightened risks of default or loss. Farmers across the country contend with multiple structural and operational hurdles. These include restricted market access for their agricultural produce, insufficient tools and mechanisms to manage production and price risks, and limited access to financing and essential inputs. These constraints impact the stability of domestic food supplies and contribute to persistent challenges around rural income generation and poverty reduction. Availability of credit and broader financial services is essential for enabling farm-level investments that drive productivity, generate employment, support rural livelihoods, and ensure smoother income flows. These outcomes, in turn, enhance market engagement and risk mitigation [7]. Financial access is also a crucial enabler of agricultural adaptation to climate change, strengthening the sector’s ability to withstand environmental shocks and thereby securing long-term food availability [8]. Despite its importance, access to diverse and appropriate financial products remains a major obstacle for small-scale farmers who make up the bulk of Jordan’s farming population. It is crucial to understand the various profiles of small-scale families and the conditions and market context in which they operate. Small-scale farmers are mostly affected by the availability and quality of financial services that are key to increasing farm productivity, profitability, and income [9]. Small-scale farmers require services that equip them with information, knowledge, and skills that enable them to cope with diverse production and marketing challenges. This entails a wide range of financial services that facilitate business and market orientation, addressing aspects such as improving farm business management, postharvest handling, linking to input and output markets, and providing digital solutions to access information and alternative markets. The government of Jordan, through the Agricultural Credit Corporation (ACC), has made an effective contribution to agricultural development and food security. It does so by providing the necessary funds and loans for crop cultivation and livestock breeding. Agricultural lending is indeed a critical mechanism for raising agricultural growth rates [7]. Loans play a crucial role in enabling farmers to increase the assets available for use in production. These assets can then be invested in infrastructure and the implementation of productive projects within the sector. This, in turn, would increase the production performance of small agricultural enterprises. It also strengthens their ability to manage debt, which is necessary to deal with downsizing seasons and other challenges confronting the agriculture sector. To this end, this paper focuses on the impacts of agricultural loans that enhance farmers' financial capacity. More specifically, it focuses on how small-scale farmers use these loans to purchase productive inputs and achieve optimal agricultural production. These loans are crucial, especially in rural communities that depend on agriculture as their main source of income. To date, there has been limited scholarly investigation into the experiences of small-scale farmers who operate independently of formal value chains and have minimal engagement in commercial agricultural activities. Little is known about their access to any financial services or the specific products and services they demand in Jordan. A report by Palladium Europe BV highlighted that small-scale farmers in Jordan with viable business cases face significant challenges in obtaining financial services, citing high collateral requirements and interest rates [10]. Another study emphasized the importance of agricultural loans in Jordan but noted disparities in loan distribution, with small landowners favoring medium-term loans [11]. These findings suggest a gap in research specifically addressing the financial access and product needs of less commercially oriented small-scale farmers in Jordan. In general, there is a lack of comprehensive insight into the range of financial options available to small-scale farmers in Jordan. Additionally, how credit constraints hinder agricultural progress and threaten national food security. Additionally, little is known about financial practices beyond the realm of commercial farming and the tight value chain segment. In response, the research objectives of this study aim to: 1) investigate the agricultural loan system in Jordan, including its operations, lending methodologies, and the types of farmers it serves; 2) explore the financial needs and demands of small-scale farmers, including value chain financing requirements; and 3) discuss the impact of government-backed loans and identify best practices for supporting small-scale farmers through agricultural lending programs.

1.1. A Conceptual Framework Grounded in Jordan’s Realities

1.1.1. Socio-economic Development of Rural Areas in Jordan

The rising global population and escalating demand for food are expected to persist in the coming years [12]. Simultaneously, recent surges in food prices have heightened international concerns over the adequacy of current agricultural output [13]. These developments have brought renewed attention to issues of food security, agricultural progress, and the importance of financial systems in expanding farmers’ access to funding [14]. While these challenges are global in scope, their implications are particularly pronounced in countries with limited natural resources and highly fragmented farming systems. In Jordan, most small-scale farmers live in rural areas and depend on agriculture as their primary livelihood and source of employment. These farmers typically manage plots of land measuring three hectares or less. Nonetheless, their limited resources play a vital role in strengthening food availability and maintaining consistent agricultural production [15]. Despite the socioeconomic importance of small-scale farmers, they tend to have limited access to formal credit and finance. This restriction reduces the ability to invest in technologies and inputs they need to boost agricultural productivity and earnings, thereby alleviating poverty. In Jordan, the rural population stands at approximately 933,557, accounting for around 8% of the country’s total population, despite experiencing a slight annual decline of 0.5% in 2021 [16]. Poverty is more prevalent in rural communities, where 17% of residents live below the poverty threshold, compared to the national average of 14.4%. An estimated 20–25% of households rely on agriculture for their livelihoods, a sector that provides significant employment opportunities for both women and refugees. However, nearly 40% of families engaged in farming activities are classified as living in poverty [5]. This suggests that rural and agricultural development are strongly related. As such, the government of Jordan seeks to supplement rural families' incomes by promoting their participation in the agricultural sector. Therefore, addressing the needs of small-scale farmers is imperative, as they confront severe challenges stemming from inadequate economic and institutional support. Small-scale farmers face limitations in their integration into markets and are often marginalized from formal innovation systems and processes [17]. In addition to concerns such as climate change, biodiversity loss, ecosystem degradation, and food waste and loss, particular concerns for small-scale farmers need to be addressed. These include a lack of access to productive resources and financial services, inadequate infrastructure, decreased food diversification, inadequate policies favoring local production and traditional foods, and long, non-inclusive value chains [18, 19]. Innovation and accessible technologies across the entire value chain are crucial for improving the livelihoods of small-scale farmers [20]. Even though the challenges affecting agrifood producers of any size are the same, the strategies required to support small-scale farmers will likely differ significantly from those designed for large-scale agricultural producers [21]. Tackling these challenges through the lens of a sustainable food system offers a more holistic and long-term approach.

1.1.2. Government Investment in the Agriculture Sector

The Agricultural Credit Corporation is the only government entity in Jordan that provides loans and financial services to farmers at a reduced interest rate. As well as making important contributions to financing Small and Medium Enterprises (SMEs) in rural areas. In fact, the government of Jordan has been instrumental in introducing various agricultural loan guarantee initiatives and developing inclusive policies. These efforts aim to empower agricultural SMEs and small-scale farmers to integrate more effectively into the agrifood processing value chain and the broader market system. Such initiatives not only enhance their financial accessibility but also encourage interaction with other stakeholders, including processors, distributors, and exporters. Ultimately, this promotes a more sustainable and interconnected agrifood system. The ACC aims to achieve integrated agriculture development by focusing on enhancing production and productivity. To achieve this, the ACC offers several loan programs tailored to support the rural and agricultural sectors. These include the rural families’ loan program, the income source diversification project, the low-income farmers project, the rural women’s project for food production, the agricultural resource management projects, the small-scale farmers’ loans to improve soil maintenance, the use of land and available water resources, and livestock keeping. Agricultural Credit Corporation extended a total of US $67 million in loans to farmers in 2018 and 2019. Over 8000 farmers and agricultural entrepreneurs, regardless of gender, benefited from the loans. Many of these loans were subsidized for the purchase of equipment, modern technologies, and resource-efficient farming technologies. There was about US $55.3 million that was administered on land activities during the year 2020, and there were 6432 borrowers who benefited from this loan to establsih agrciulutral projects [22]. The Government of Jordan approved a national plan to expand the cultivation of wheat and barley crops, characterized by incentives and the allocation of interest-free loan packages to support farmers through agricultural lending. However, cultivation of wheat and barley crops is linked to the availability of sufficient water resources for agriculture. Another government entity in Jordan is the Agricultural Risk Management Fund, established in 2009 to enhance farmers' resilience by providing financial and risk-management solutions to help protect them from climate-related losses. This organization provided about US $1.7 million in compensation to farmers in 2017. The payments were made in response to significant financial losses due to extreme weather, such as floods, frost, and strong winds, which damaged farmers’ crops [23]. Currently, the Agricultural Risk Management Fund reimburses approximately US $2.85 million per year to farmers for weather-related damage. The government's financial scheme aims to exploit available agricultural resources efficiently and sustainably, and to help reduce unemployment and poverty in rural areas. The government's strategic goal is to enhance institutional performance by providing reliable financial services tailored to the agriculture sector, while expanding and diversifying funding sources. Notably, overall capital input into the agriculture sector increased significantly between 2009 and 2016. These inputs include land, livestock, storage, supplies, equipment, irrigation systems, seeds, and fertilizers, among others. However, investment in labor decreased during the same period due to access to comparatively low-cost foreign labor [24].

1.1.3. Agriculture and Food Security in Jordan-an Overview

Jordan's agricultural sector is confronted with significant obstacles that jeopardize its long-term viability and the nation’s food security. These difficulties arise from a mix of limited water availability, harsh climatic conditions, and political instability in the region. They are further compounded by economic factors such as unemployment, rising food prices, and crises such as the COVID-19 pandemic. Additionally, the ongoing conflict between Russia and Ukraine has further strained food systems, exacerbating existing vulnerabilities in the sector. A critical issue facing agriculture in Jordan is the fragmentation of farmland, where many rural households own multiple, non-contiguous plots scattered across different areas. This pattern highlights inefficiencies in land governance, underdeveloped land tenure frameworks, and weak spatial planning. As a result, farmers struggle to scale their operations effectively, which limits profitability and contributes to environmental harm, including soil degradation and erosion [25]. Despite government interventions such as water-use subsidies, import tariffs, and export levies, the cost of agricultural operations has continued to rise. Although labor expenses have declined due to an influx of lower-cost foreign workers, investments in human capital deliver a lower economic return than capital investments. Nonetheless, many farmers still opt for inexpensive labor, as the costs of essential agricultural inputs like seeds, fertilizers, and agrochemicals remain high. A further constraint is the lack of access to advanced, efficient farming technologies, which prevents farmers from modernizing their operations or benefiting from economies of scale. The dominance of middlemen in the supply chain also diminishes farmers' earnings, as they receive minimal returns on their produce in both domestic and export markets. Financial institutions and credit mechanisms often do not adequately serve this group, hindering agricultural expansion. Farmers cooperatives, in particular, face difficulties in absorbing financial pressures and are often unable to coordinate effectively, which weakens the sector’s capacity to scale up operations in priority areas [25]. Climate change further complicates these challenges, with declining rainfall, rising drought frequency, and worsening land degradation. These effects severely impact productivity, especially for farmers relying on rain-fed crops and livestock grazing. This environmental stress has contributed to reduced agricultural output among small-scale producers. Although agriculture accounted for just 5.2% of Jordan’s GDP in 2020 [26] and rose modestly to 6% by 2023, according to the Ministry of Agriculture, its broader economic influence is substantial. Through its extended value chain, the sector contributes roughly 25–30% to the economy. Jordan has achieved self-reliance in several agricultural commodities, such as fruits, vegetables, poultry, olive oil, and eggs. However, it remains dependent on imports of staple goods such as wheat, barley, and red meat [27]. In 2022, Jordan ranked 47th out of 113 countries on the Global Food Security Index (GFSI), with a score of 66.2 out of 100, reflecting its overall performance across the GFSI’s four key dimensions. These pillars are economic resilience (affordability), production and agricultural resilience (availability), nutritional resilience (quality and safety), and environmental resilience (sustainability and adaptation) [28]. The prevalence of undernourishment was 8.5% and the number of undernourished was 0.9 million out of the total population in Jordan between 2017 and 2019 [29]. However, these numbers are expected to increase due to the ongoing conflict between Russia and Ukraine, the negative impact of climate change, and the deterioration of land and water resources. The post-COVID-19 period has further weakened the economy, adding to this fragility.

2. MATERIALS AND METHODS

In light of this recognition, questions emerged about the government's role in supporting small-scale farmers. These questions were: what are the most important operations that have been financed, types of loans, issues in loan guarantees with farmers, priorities of agricultural lending in supporting projects, the impact of supporting agricultural projects, the nature and value of loans, geographical distribution of the loans within the country in the last five years, risks of financing and granting loans to small-scale farmers and how these risks can be reduced, the impact of crisis such as the COVID-19 pandemic on granting loans, the role of government’s investment in developing and strengthening the role of women in the agricultural sector, and the relationship and cooperation between the government funding agencies. Further questions emerged for the focus group discussions (FGDs) with farmers, regarding government-provided financing, loan application procedures, and socio-economic benefits. Specifically, participants were asked about the role of financial support and credit in increasing farm output, diversifying agricultural activities, improving household income, supporting investment in new technologies, and maintaining the long-term sustainability of farming. A review of the literature and a content analysis of relevant policy papers and official reports form the foundation for a thorough and systematic assessment of the role of government in securing farmers’ access to financial services in Jordan. The initial stage of this research devised a structured questionnaire to explore the financial needs and preferences of small-scale farmers in relation to their farming practices. The research study then set out two main phases of original data collection activities. The first one was in-depth interviews with the Key Informant (KI) of the ACC, and, to some extent, document studies of the literature review. The second one was the FGDs with farmers in two selected sites in Jordan: the Jordan Valley and the Mafraq Governorate. An in-depth case study approach was adopted and involved institutions and individual participants across Jordan. Data collection methods included key informant interviews and group discussions with farmers to analyze government investment through ACC and the impact of government-backed debt on small-scale farmers in Jordan. Together, the case study and the overarching review of scholarly sources and policy framework contribute to the central claim of this study. Advancing socio-economic progress and fostering resilient rural livelihoods in the agricultural sector require stronger government engagement and expanded support mechanisms for farmers and rural communities. The synergy between the literature review, empirical data collection processes, and the researcher’s introspective reflections [30] was achieved by conducting the literature review both prior to and concurrently with fieldwork. Although FGDs are often used qualitatively, in this study, they included structured components such as closed-ended questions and ratings on a four-point Likert-type scale to generate quantitative data on the impact of finance and loans, socio-economic development, and the benefits and contributions of finance and loans. These responses were aggregated and analyzed quantitatively across participants, and summarized using descriptive statistics (frequency and percentage) to identify trends and priority areas. Using structured quantitative elements within FGDs complemented the qualitative insights from KI interviews, enabling a comprehensive mixed-methods design that captured both measurable trends and in-depth perspectives. This approach fits within a broader quantitative analysis because the numerical data could be systematically analyzed to reveal patterns and relative importance, adding statistical weight to the qualitative themes identified.

2.1. Techniques for Data Collection and Interpretation

This study was conceptualized using a case study framework, selecting a specific context in collaboration with partner organizations such as ACC, Agricultural Risk Management Fund, and the Ministry of Agriculture. This collaboration with these key national organizations was integral to this study. These organizations facilitated our research study, provided access to relevant data set, policy documents, and operational guidelines. They also facilitated connections with beneficiary farmers, enabling the collection of primary data through KI and FGDs. Their involvement ensured that the research captured both policy-level perspectives and on-the-ground realities, thereby strengthening the validity and comprehensiveness of the findings. The case study strategically aligned the methods of data acquisition and interpretation with the core research objectives [31]. Emphasis was placed on the qualitative dimension to capture deeper insights into institutional dynamics and farmer perspectives because of the exploratory nature of the research questions [32]. The research study has a main phase that involves human participants for data collection. Participants were contacted regarding the qualitative research on the government's contribution to supporting small-scale farmers, the operations that have been financed, the types of loans, issues with loan guarantees for farmers, the priorities of agricultural lending in supporting projects, and the impact of supporting agricultural projects. In-depth KI interviews were conducted with 39 individuals involved in agricultural lending and financing for farmers and members of rural communities from Jordan, between March and September 2023, at the sites of ACC, the Agricultural Risk Management Fund, and the Ministry of Agriculture in Jordan. Participants for the KI interviews were selected using a purposive and criterion-based sampling strategy, prioritizing individuals with direct relevance and expertise on the topic. The selection of study subjects was validated by cross-checking public sources, such as online profiles, expert referrals, and professional networks, to ensure their familiarity with and engagement in the subject matter under investigation [33]. Participants were from diverse backgrounds and held professional roles within their respective institutions, including titles such as Director General, Secretary General, Project Manager, Agricultural Loan Manager, Agricultural Credit Officer, Assistant Manager, Business Development Officer, Head of International Cooperation, and Finance Manager. The interview framework was organized into two primary sets of questions. The first included standardized questions posed to all participants, while the second comprised of case-specific inquiries focused on agricultural lending systems and access to finance within Jordan. Thematic areas identified in the academic literature were used to shape the structure and content of the interviews, ensuring contextual relevance. A structured review of the existing literature provided a foundation for shaping both the research methodology and the analytical approach [34]. This review contributed significantly to defining the research design, shaping the interview guide, and informing participant selection decisions [35]. To foster open, meaningful dialogue and elicit authentic insights, interviews were conducted in an informal, conversational manner. This flexible format encouraged participants to share their personal perspectives and enabled a diversity of experiences to emerge. It also enabled the discussions to naturally evolve around key themes, often extending beyond the scope of the original questions, enriching the overall data quality and depth of analysis. With each participant's informed consent, all interviews were documented manually in handwritten notes. These records were subsequently transcribed and translated by the researchers. Prior to commencing the analysis, the content was reviewed and verified for precision to ensure reliable identification of recurring patterns and emerging themes. After each interview, a detailed description of the interviewees' pondered thoughts was recorded in a reflective journal, which was used to align with and speculate on the original views of the interviewees. All research activities were approved under the research ethics protocol of the Scientific Research and Innovation Support Fund (SRISF) and the research institution in 2023. The data from KI interviews were analyzed descriptively using a rigorous interpretive process [30, 36]. Researchers applied a continuous comparison strategy [37] alongside an inductive coding approach. This enabled the identification of emerging patterns related to the influence of government-supported credit programs on small-scale farmers in Jordan. The analysis followed a structured framework to comprehensively understand the study's methodology, coding structure, and theoretical implications. For data analysis, the research team adopted Bryant’s four-phase analytical model [38], which necessitates the researcher’s deep engagement with the data through iterative review cycles. Initially, the interviews and focus group data were transcribed into text form, followed by multiple readings of these transcripts and the researcher’s reflective field notes to ensure familiarity with the content. In the second phase, emerging concepts were identified and refined using an “initial coding” technique [39]. This allowed the researchers to remain open to unexpected insights. These preliminary codes were progressively expanded, revised, and merged to reflect evolving interpretations. The same researchers who conducted the interviews and group discussions led this interpretive process, maintaining continuity and contextual sensitivity. The third phase involved systematic annotation and organization of the codes. A finalized set of themes was constructed by grouping related categories and refining the code structure based on the insights derived from the transcripts. Re-coding was performed where necessary to enhance coding consistency and ensure alignment with analytical goals. This stage included rigorous cross-checking to validate the integrity, coherence, and relevance of the thematic categories. In the final stage, the researchers synthesized the data and reflected on how the coded themes aligned with the overarching research aims. This interpretive synthesis informed the development of meaningful insights and theoretical contributions. For organizational purposes, all qualitative data were transferred into Microsoft Excel, where they were sorted, compiled, and systematically categorized to facilitate coding and in-depth thematic analysis. A purposive sampling approach was used to recruit participants for the FGDs. Three FGDs were conducted with 42 participants, all small-scale farmers from two key agricultural regions in Jordan: the Jordan Valley and Mafraq Governorate. The three FGDs were conducted between March and June 2023. Participants were identified and invited through established farmer organizations, agricultural cooperatives, and local civil society groups. This ensured that they were actively engaged in farming activities and represented diverse experiences within the small-scale farming community. This strategy allowed the study to capture region-specific perspectives and a range of farming contexts relevant to the research objectives. The questionnaire consisted of 10 specific questions on: 1) financing and loans, 2) the procedure of obtaining a loan, 3) the benefits of these financial services, 4) increasing the cultivated area as a result of these loans, 5) diversification of agricultural loans, 6) the role of finance or loan in increasing productivity of the farm, 7) increasing income and the economic status of farmers, 8) the contribution to improve the livelihood of farmers, 9) investing in new agricultural technology, and adoption of modern technologies for sustainability of agricultural work, and 10) continuation of the project activities. Participants were given the opportunity to respond to the questionnaire using a four-point Likert-type scale. In particular, Likert-type scale questions were used to measure the impact of finance, socio-economic development, the benefits and contributions of finance, and loans. The ordinal data from the FGDs were analyzed using descriptive statistics (frequency and percentage) in SPSS. The quantitative data collected from FGDs were ordinal (ratings and response frequencies). As such, descriptive statistics, such as frequencies and percentages, were the most appropriate measures for summarizing and presenting the data. The purpose of the quantitative component in this study was to present the distribution and summarize the patterns of responses across participants.

3. RESULTS

The results are divided into two subsections: The First Highlights Findings from the KI Interviews, while the Second Presents Insights from the Focus group discussions.

3.1. Findings from the KI Interviews

All participants asserted that agricultural loans and more specifically, the ACC have contributed to supporting, evaluating, and developing the agricultural sector. The ACC plays an important role in the agricultural finance sector, and it has raised its profile and continued the path of giving and building to contribute to comprehensive agricultural and rural development by providing financing services that meet the needs of farmers in the agricultural sector, with high quality and efficiency. The organization plays a leading role in the direct financing of agricultural projects at very low interest rates compared to other banking sectors. All loan transactions were exempt from fees and were granted to all categories of farmers to set up agricultural projects up to US $215,000. These loans provide the cash flow farmers need for the continuity and development of agricultural work and for solving the problems they face during the process. The organization also serves as an advisory body, guiding farmers through the agricultural process and helping them expand their existing projects. Interestingly, farmers showed increasing confidence in the government's investment and its role in developing the agricultural sector and supporting farmers financially in emergency circumstances such as the COVID-19 pandemic. Furthermore, seasonal loans enabled small-scale farmers to continue their work in the event of interruptions due to climatic conditions and marketing problems, which often lead to a lack of gain and broader issues affecting agricultural production.

3.1.1. Loan Types

The ACC is the only financing agency for the agricultural sector in Jordan. Agricultural products and contract-based crops remain largely uninsured, as insurance providers are reluctant to offer coverage due to the elevated levels of risk associated with farming ventures. Despite this need, a functional and long-term agricultural insurance framework has yet to be established in the country. The absence of such a system is largely attributed to the numerous and complex risks that discourage financial institutions from actively engaging with this sector and challenges associated with agricultural production and lending, including seasonality and the associated irregular cash flows, high transaction costs, and systemic risks, such as floods, droughts, and plant diseases. From 1960 until the end of 2020, as shown below in Table 1, the government of Jordan spent about US $1.223 billion in developmental and operational loans for short-term (two years), medium-term (two to eight years), and long-term (eight to ten years) for about 273 thousand farmers across the country.

In the last few years, the government contributed to sustainable and inclusive economic development and the eradication of poverty by providing finance and granting loans for several agricultural initiatives and activities in the countryside and rural regions, the finance schema was divided into US $193 million for 4 years, US $38.5 million for 11 initiative projects, and US $80 million free of interest, these finance and loans were focused on several themes as illustrated below in Table 2.

The essential fields and activities in agriculture that have been financed and supported by agricultural loans are: 1) agricultural production inputs, 2) farming infrastructure such as developing of irrigation sources, land reclamation, greenhouses, water harvesting, and water collection wells, 3) modern technologies in the date palm farms, 4) marketing, 5) rural projects for unemployed youth and women, 6) solar energy projects, 7) grading and packaging factories, 8) fish farming, 9) growing new crops such as tropical crops and alfalfa, 10) hydroponics projects, 11) livestock development such as raising sheep and cows, buying feed, 12) home based businesses such as milk and cheese processing, cow breeding, sheep breeding, 13) nurseries, 14) honey bee production, and other agricultural projects that have economic feasibility. However, livestock production and feed purchases accounted for the highest percentage of loans, reaching 70% of the total. Generally, loans were divided into five types: 1) Type A loans, these are fixed loans that can be used for constructing warehouses and greenhouses, mobile loans for buying sheep, goat, cows, and relevant production inputs, 2) Type B loans, these are seasonal loans for a one-year period and can be used for plowing and preparing the land, farming operations, seeds, fertilizers, animal feed, or any seasonal operating costs, 3) Short-term loans for two years, 4) Medium- term developmental loans for two to eight years, and 5) Long-term developmental loans for eight to ten years.

3.1.2. Challenges

In general, all participants have noticed greater ease and flexibility in granting loans to beneficiaries. However, any initiative project must be convincing and meet the lenders' required conditions. It would be easier for farmers to obtain a loan if they own the land and have guarantees of repayment. Other conditions might be applied for obtaining the loan, such as the availability of real estate guarantees (first-degree mortgage) or a notary guarantee, and the availability of payment methods (for example, monthly deduction and/or bank checks). The value of financing often reaches 75% of the property’s value.

Table 1.

| Investment projects | Loan value in US$ (millions) | Percentage (%) |

|---|---|---|

| Reconstruction, exploitation of agricultural land, and rural infrastructure | 186 | 15.20 |

| Water, the use of modern technologies, and solar energy | 178 | 14.55 |

| Development of animal production | 417,850 | 34.17 |

| Agrifood processing, marketing and purchasing equipment | 145,150 | 11.88 |

| Requirements of agricultural production (plants and animals) | 277 | 22.65 |

| Rural finance | 19 | 1.55 |

| Total | 1,223 | 100 |

| Themes were supported for finance and loans | Loan value in US$ |

|---|---|

| Non-traditional and innovative agriculture such as tropical agriculture, fish farming and contract and industrial agriculture | 21,400,000 |

| Sheep and goat production inputs, such as feed | 7,100,000 |

| Women empowerment | 21,400,000 |

| Youth empowerment | 11,400,000 |

| Plant production supplies for small vegetable farmers | 14,285 |

| Total | 61,314,285 |

Most of the obstacles to granting a loan are related to monthly deductions and rebates. However, collateral is essential to every loan. There were cases of requesting feasibility studies for the prospective projects. In general, there were no obstacles to loan guarantees, but there were conditions to ensure that the lending institution recovers the loan’s value and ensures the project’s success so that the farmer can repay the loan. The value of the debt (the bank mortgage) must be less than 20% of the value of the guarantee (the mortgaged land or property), as there are minimum and upper limit estimates for each item. As one interviewee pointed out, in the case of the loan holder's death, there were problems with the heirs. There were also other urgent financial claims, such as divorce expenses and the insufficiency of the remainder of the farmer's salary. The farmer's marital status and overall social status were also considered. The absence of real estate guarantees for the mortgage, such as the project land being rented or a stable, demonstrable repayment mechanism for the monthly dues. Most farmers who borrowed from the institution were 55-70 years old; therefore, they should have a mortgage on land or real estate to guarantee the lending institution’s right to recover the loan.

As one participant explained during an in-depth interview, there were reasons for rejection of funding such as: 1) violation of the specific conditions for granting a loan, 2) unavailability of guarantors, 3) non-compliant farmer who was placed on the black list, 4) illogicality of the agricultural project and lack of economic feasibility, 5) impossibility of the success of the agricultural project, 6) lack of previous experience of the farmer in specific projects that require prior experiences, such as fish farming, 7) changing the loan objectives for another project or not using the loan for its purpose, especially in fixed projects, where the loan’s value is disbursed in installments, 8) the debtor defaults in the repayment process on a previous loan, and 9) providing incorrect data and information or deception to obtain an agricultural loan which normally recorded upon sensory detection, where the lending institution find that there is no agricultural project.

Other participants confirmed that supporting projects and granting loans by the lending institution had positive socioeconomic impacts on small-scale farmers and the outcomes were: 1) reducing the total costs of the farmer which led to an increase in net farm income, 2) establishing and linking farmers to agricultural work in rural areas lead to a reduction in migration, and therefore achieving agricultural sustainability, 3) conserving the existing agricultural projects, 4) directing farmers towards new quality agricultural projects that generate higher profit, 5) supporting farmers and encouraging them to marketing agrifood products and generating income, and 6) providing work opportunities for rural families and a stable source of income in rural areas as was pointed out by participants. For example, transforming the Jerash region into a market for agricultural nurseries where many nurseries have been supported in that region, supporting projects for the manufacturing and processing of livestock products, and home-based businesses for dairy and cheese products. In addition to introducing new technologies to the farms, it provides the necessary data and information on agricultural equipment. Another participant stated that the impact was obvious. The funding enabled investment in food processing projects such as milk, labaneh (strained yogurt), and cheese, cactus nursery projects, pickles factories, bee breeding factories for honey production, potato processing plant, establishing a date palm farm, establishing sorting, packing, grading, and storage warehouses, cultivating mushroom, producing soap and vinegar products, and therefore, maximizing the role of small-scale farmers in the national food security.

3.1.3. Impacts

To understand the implications of the COVID-19 pandemic on loan distribution, respondents were asked about its impact and the measures taken by lending institutions to support small-scale farmers. All respondents stated that farmers' ability to repay loans has been negatively affected during the COVID-19 pandemic. The COVID-19 pandemic significantly affected the payment of monthly installments and borrowers' ability to repay their loans, due to its impact on the marketing of agrifood products. The lending institution took several steps to support small-scale farmers and reduce the effects of COVID-19 as follows: 1) loan installments have been postponed for a period of six months during the period 2020-2021, 2) rescheduling of loans has been made for all farmers but this led to a significant decrease of the cash flow in the lending institution, and 3) a funding package was released to support the agricultural sector, with US $50 million, and launching loans with interest-free in 2021. The funding package and interest-free loans targeted projects that have an impact on women's empowerment, youth support, employment, and livestock feed purchases.

Most respondents shared the same view, asserting that the impact of agricultural loans and government investment in the agricultural sector was evident. This was notable in raising the efficiency of the use of available natural resources and irrigation network, introducing new agricultural technologies, increasing the cultivable areas, directing farmers towards pioneering and developmental agricultural projects to achieve a higher profit, creating new job opportunities for unemployed youth, and supporting rural families and rural women to have a stable source of income. The agricultural loans and government investment during the pandemic not only addressed immediate challenges but also played a critical role in supporting the national economy. As many participants pointed out, the government allocated and granted funding of US $7000 for most of the projects, which significantly contributed to providing at least one job opportunity for these projects and to perpetuating agricultural work at the family level. Furthermore, government investment made a significant contribution to maintaining and sustaining the country's agriculture sector, which drives many economic and industrial sectors.

It seems there is a clear role for government investment, and more specifically for the ACC, in supporting and empowering women through funding and loan grants for home-based and food-processing projects, such as productive kitchens and home manufacturing businesses. Food processing initiatives set up by small-scale farmers and rural women have become important venues for marketing agrifood products in certain governorates. Agricultural loans were available to women, and they were given preference in particular projects, such as women’s empowerment projects. The loans were granted without interest to encourage rural women to start home-based businesses and private projects.

Cooperation and partnership between government entities were based on a mutual understanding of the common goal, while creating public value by working together to efficiently use resources and divide responsibilities. The mutual interests in managing and operating agricultural loans and in government investment in the agriculture sector were clearly evident across several government organizations. For example, there was a collaborative agreement between the ACC and Jordan Cooperative Corporation, under which loans were granted to the registered agricultural cooperatives within the Jordan Cooperative Corporation. However, one participant indicated that there was no agreement between the ACC and the Agricultural Risk Management Fund, but that the Risk Management Fund was engaged on an advisory basis when circumstances required. Furthermore, the ACC maintained an outstanding relationship with other government organizations operating in the agriculture sector, such as the Ministry of Agriculture, the National Agricultural Research Center, the Association of Agricultural Engineers, and the General Authority of Veterans.

Overall, the perspectives shared by key informants shed light on the strategic vision, institutional priorities, and operational frameworks guiding the government-backed loans program. These insights highlight the intended mechanisms for improving small-scale farmers’ access to finance, the role of partner organizations, and the challenges faced in program implementation. However, these findings largely reflect the views of policymakers, program administrators, and institutional actors. To provide a more complete picture, it is essential to examine how these policies and processes are experienced at the grassroots level. The following section presents results from FGDs with small-scale farmers, offering direct accounts of their interactions with the loan program, perceived benefits, and challenges in accessing and using these financial services.

3.2. Findings from the Focus Group Discussions

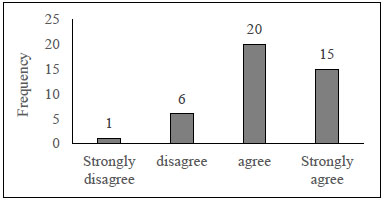

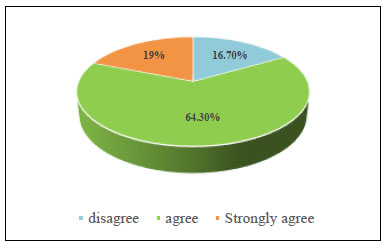

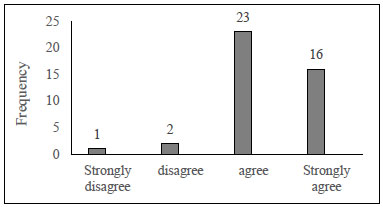

In the focus group discussions, participants were given the opportunity to score the questions and provide responses to the questionnaire based on a four-point Likert-type scale (1 = strongly disagree / weak / not important / seldom, 2 = disagree / acceptable / moderately important / sometimes, 3 = agree / good / important / often, and 4 = strongly agree / very good / very important / always). In particular, there were three large focus group discussions. In total, 42 participants were asked to score 10 questions to measure the impact of finance, socio-economic development, benefits, and the contribution of finance and loans. Participants provided scores to the original questions based on their experiences and perceived importance. Most of respondents confirmed their satisfaction on financing or loan provided by the ACC, 15 out of 42 strongly agreed and 20 out of 42 agreed, this is an indication of the interest rates that were offered by the ACC were competitive and reasonable, and the terms and conditions of the loan including the repayment period, grace periods, and any collateral requirements, play a significant role as shown in Fig. (1).

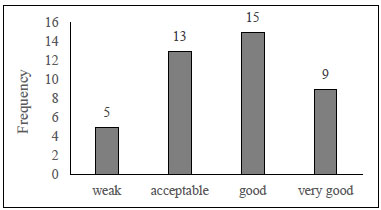

Most of the respondents indicated that procedures for obtaining financing or loans fell under the category of “very good” (9 out of 42) and “good” (15 out of 42), which means that farmers appreciate flexible procedures and farmer-friendly terms, therefore, procedures and accessibility of the financing or loan options are crucial as shown in Fig. (2).

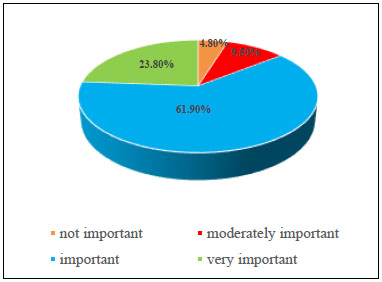

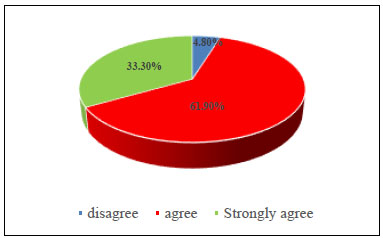

The majority of respondents-23.80% very important and 61.90% important-asserted that they benefit from financial services and invest them for the same purpose. Ultimately, the success of the financing is based on the impact it has on farmers’ agricultural productivity and the loan’s contribution to increased yields, improved farming practices, and overall economic well-being, as shown in Fig. (3).

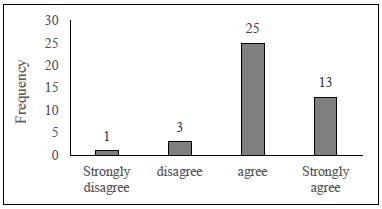

The majority of respondents-19% strongly agreed and 64.3% agreed-reported an increase in cultivated area after receiving financing. This suggests that farmers were able to secure funding that met their specific agricultural needs, as shown in Fig. (4).

Most of the respondents confirmed diversification of agricultural activities after financing, (13 out of 42) strongly agreed and (25 out of 42) agreed, this indicates that financial services are essential and tailored to meet the unique needs of farmers and contribute positively to their agricultural activities and livelihoods, as shown in Fig. (5).

The frequency of financing provided by the Agricultural Credit Corporation is most identified and agreed upon by participants.

The frequency of procedures for obtaining financing is most effective for participants.

Farmers’ perceptions of the importance of financing services and investing the funds for sustaining and expanding agricultural production.

Frequency distribution of participants’ agreement that the cultivated area increased as a result of financing support.

The majority of respondents (33.30% strongly agreed and 61.90% agreed) indicated that financing contributed to increased farm productivity by providing the necessary capital for investment. This funding supported a range of activities, including purchasing equipment and agricultural technologies, constructing greenhouses and irrigation systems, acquiring seeds and fertilizers, and covering operational costs, as shown in Fig. (6).

The frequency of diversification of agricultural activities after financing was most agreed upon by participants.

Participants’ agreement levels on the role of financing or loans in increasing farm productivity, based on response frequency.

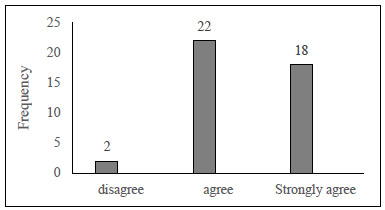

Most respondents indicated that financing contributed to increasing income and improving the economic status of farmers (18 out of 42) strongly agreed and (22 out of 42) agreed, which means that the financial support is crucial to improve the economic outcomes for farmers, as shown in Fig. (7).

Most of the respondents asserted that finance or loans contributed to improving the social situation of farmers, (16 out of 42) strongly agreed, and (23 out of 42) agreed. Providing financial services and improving access to finance can significantly contribute to poverty reduction by enhancing farmers' incomes and living standards, as shown in Fig. (8).

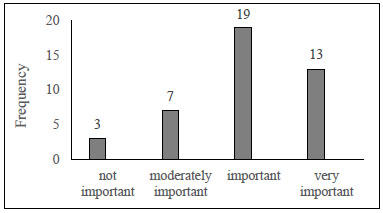

Of those responses, (13 out of 42) were very important and (19 out of 42) were important, as shown in Fig. (9). The majority of responses asserted the importance of financing or loans for investing in new agricultural technologies and theirs adoption for the the sustainability of agricultural work. Farmers often require funds to invest in modern technologies, high-quality seeds, fertilizers, and machinery. Access to finance enables them to make these investments, thereby increasing productivity and yields.

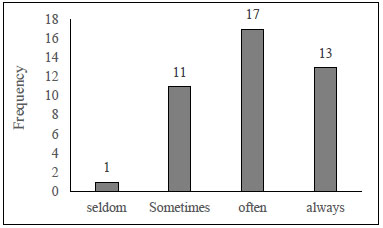

Of the respondents, 13 out of 42 reported “always” and 17 out of 42 reported “often” as shown in Fig. (10). The majority indicated that project activities continued after the funding period ended. This is crucial for the long-term success and future viability of agricultural initiatives. Public sector involvement and strategic policymaking are essential to strengthening the adaptability and resilience of these projects, empowering farmers to maintain their operations effectively beyond the period of financial assistance or loan repayment.

The frequency of contribution of financing in increasing income and improving economic status, as most agreed by participants.

The frequency of contributions to financing to improve the social situation.

The importance of financing for investing in new agricultural technologies and their adoption for the sustainability of agricultural work was identified as “important” by participants.

The frequency of continuity of project activities after the end of the financed project period, as identified by participants.

| Statement | Mean* | Standard deviation |

|---|---|---|

| Financing or a loan provided by the ACC | 3.2 | 0.76 |

| Procedures for obtaining financing or a loan | 2.7 | 0.95 |

| Benefiting from financing services and investing them for the same purpose | 3.0 | 0.73 |

| Increasing the cultivated area after financing | 3.0 | 0.60 |

| Diversification of agricultural activities after financing | 3.2 | 0.67 |

| The contribution of financing or loans to increasing farm productivity | 3.3 | 0.55 |

| Contribution of financing or loans in increasing income and improving economic status | 3.4 | 0.58 |

| Contribution of financing or a loan in improving the social situation | 3.3 | 0.67 |

| The importance of financing or loans in investing in a new agricultural technology and its adoption for the sustainability of agricultural work | 3.0 | 0.88 |

| Continuity of project activities after the end of the financed project period | 3.0 | 0.83 |

Most responses identified by participants were rated ‘important’ and ‘very important’, ‘agree’ and ‘strongly agree’, ‘good’ and ‘very good’, ‘often’ and ‘always’, with a mean ranging from 2.7 to 3.4. Results from the focus group discussions are summarized in Table 3 below, with mean scores and standard deviations (SD) for each individual response.

4. DISCUSSION

It is clear from this study that the ACC in Jordan provides subsidized loans, grants, guarantees, etc. that can support beneficiaries in purchasing equipment to improve their on-farm, cultivating more saline and drought-tolerant crops, upgrading technologies to become more resilient to climate change, achieving cost savings through resource efficiency, and promoting productivity (improving profits and revenues). On the one hand, it is argued that establishing an agricultural insurance company can more effectively address risk and damage, providing greater environmental and social benefits than a reimbursement-based system. However, this strategy can be done only if there is a political commitment and appropriate funding. This research indicates that successful agricultural lending does not rely on land or fixed assets as collateral, at least not for loans below a certain threshold. The findings reveal a wide range of collateral and/ or guarantee requirements in use, with requirements seemingly correlated with loan size. This seems to reflect both system limitations and the learning process of the institutions, for example, the process of getting to know the client's needs and payment capacity. Furthermore, direct lending is the predominant approach for providing financing to small-scale farmers. These findings align with several research findings in agricultural finance and loans [40-43]. The evidence indicates that access to credit and financial resources enable farmers to benefit from potential investment opportunities in agriculture. This, in turn, enhances the socio-economic development of rural people's livelihoods. These findings are in line with several empirical studies [40, 44-46].

On the other hand, this stimulates farmers to adopt new and modern technologies. There is evidence that the government of Jordan’s investment in agricultural loan services for small-scale farmers has generated positive benefits and impacts. This investment has had a significant effect on the financial stability and growth of small-scale farmers in Jordan. These loans provide farmers with the financial resources to purchase inputs -such as seeds, fertilizers, and equipment -and to cover operating expenses. Additionally, they also support investment in farm infrastructure, such as irrigation systems, storage facilities, and machinery, which can increase farm productivity and profitability in the long run. These findings align with several studies that emphasize the transformative role of credit in improving agricultural productivity and profitability [44, 47-49].

Previous research has found that access to agricultural loans and finance varies significantly and is influenced by age, gender, and education level [7, 10]. Young farmers often face barriers to accessing agricultural loans and finance due to limited credit histories, collateral, and perceived risk by lenders. However, the ACC in Jordan promoted some financial programs targeting youth to encourage innovation and sustainability in agriculture. Furthermore, if the application process is streamlined and farmers can easily access loans when needed, it contributes to their well-being.

In this research study, participants from both genders asserted that agricultural loans have a profound impact on their financial and social well-being. These loans provide farmers with the financial resources they need to invest in their farms and improve their productivity and profitability. In turn, this increased profitability can lead to improved food security, higher incomes, and better living standards for farmers and their families. Additionally, agricultural loans can help reduce poverty and promote economic growth in rural areas by stimulating job creation and expanding market access. However, agricultural loans are not without challenges. Small-scale farmers of both genders often face difficulty accessing loans due to a lack of collateral, credit history, and financial literacy. High interest rates, fees, and the requirement for collateral can also increase the risk of debt and limit farmers' ability to invest in their farms. In the context of agricultural loans and access to finance, innovative communication tools can play a crucial role in raising awareness, educating farmers, and improving uptake of financial services. In a parallel vein, a study focused on utilizing Instagram illustrates how social media can serve as an effective tool [50]. This study underscores the power of social media in conveying complex topics, such as the intricacies of agricultural finance and its impact on small-scale farming, to a broad audience. Such initiatives complement the role of influencers in rural development and agricultural communication by providing tangible examples of how digital platforms can foster community engagement and awareness in specialized areas.

5. STUDY LIMITATIONS

This study has a few limitations that should be acknowledged. First, the analysis relies on data from a specific region and time period, which may limit the generalizability of the findings to other contexts. Second, while efforts were made to ensure accuracy and completeness, some data sources may be subject to reporting biases or measurement constraints. Finally, certain factors influencing agricultural finance and small-scale farmers’ outcomes, such as informal credit mechanisms or unobserved socio-economic variables, were not captured in this study. Future research could address these limitations by using broader datasets, conducting longitudinal analyses, and including additional contextual variables.

CONCLUSION

In conclusion, agricultural loans have significant potential to support the growth and development of small-scale farmers. However, careful financial analysis, appropriate loan terms, and tailored financial education programs are essential to ensure that small-scale farmers can access loans that meet their needs and use them effectively to improve their farms’ productivity and profitability. By addressing these challenges, agricultural loans can contribute to poverty reduction, economic growth, and improved food security in rural areas. This study explored the financial needs of small-scale farmers in Jordan, assessed the impact of government-backed agricultural loans, and examined best practices for improving access to finance. The findings indicate that small-scale farmers primarily require financial support to purchase inputs, expand cultivated areas, and adopt modern technologies. While government-backed loans have helped many farmers meet these needs, the study also identified barriers, such as complex eligibility criteria, insufficient financial literacy, and limited access to advisory services, that constrain the effective use of loans. The evidence further shows that agricultural loans contribute to increased farm productivity, enhanced income stability, and greater engagement in market-oriented production. The study highlights practical lessons for both national and regional policy. Strengthening the legal and institutional framework, promoting financial literacy, and facilitating farmer access to credit can improve agricultural productivity and resilience in rural communities. These findings are relevant not only for Jordan but also for other countries with similar smallholder farming contexts, suggesting that well-designed financial support programs can play a critical role in advancing rural livelihoods, food security, and sustainable agricultural development.

Finally, Building on these findings, the study underlines the need for further research focused on strategies and policies that the government of Jordan can implement to strengthen the system of agricultural loans. In particular, examining the coherence of the legal and policy framework, as well as the governance of the agricultural credit system, could play a key role in enhancing financial inclusion and supporting the sustainable development of the agriculture sector in Jordan.

AUTHORS’ CONTRIBUTIONS

The authors confirm contribution to the paper as follows: N.T.: Secured and managed the funding for this research, devised and investigated the methodology, conceptualized and curated the data, collected and analyzed the data, administered the project and resources, and supervised, validated, visualized, wrote, reviewed, and edited the original draft; L.A.N. and N.H.: Analyzed the data and conceptualized the work. All authors have reviewed and approved the final version.

LIST OF ABBREVIATIONS

| ACC | = Agricultural Credit Corporation |

| COVID-19 | = Coronavirus disease 2019 |

| GFSI | = Global Food Security Index |

| GDP | = Gross Domestic Product |

| SRISF | = Scientific Research and Innovation Support Fund |

| SD | = Standard Deviation |

| SMEs | = Small and Medium Enterprises |

ETHICS APPROVAL AND CONSENT TO PARTICIPATE

The study was conducted in accordance with the Declaration of the Scientific Research and Innovation Support Fund (SRISF) of the Ministry of Higher Education in Jordan and was approved by the Scientific and Ethics Committee at the National Agricultural Research Center in Jordan [FS-Agr/3/2021].

HUMAN AND ANIMAL RIGHTS

All procedures performed in studies involving human participants were in accordance with the ethical standards of institutional and/or research committee and with the 1975 Declaration of Helsinki, as revised in 2013.

CONSENT FOR PUBLICATION

With each participant's informed consent, all interviews were documented manually in handwritten notes.

AVAILABILITY OF DATA AND MATERIALS

The data supporting the findings of the article will be available from the corresponding author [N.T] upon reasonable request.

FUNDING

This research was financially supported by the Scientific Research and Innovation Support Fund (SRISF), Ministry of Higher Education, Amman, Jordan [grant numbers, FS-Agr/3/2021].

ACKNOWLEDGEMENTS

We sincerely acknowledge the supported by the Scientific Research and Innovation Support Fund (SRISF), Ministry of Higher Education, Amman, Jordan. No funding agency directed any part of this research or had any input on the research design, data collection methods, data analysis, research outcomes, or the final dissemination of results. No funders have ownership of any part of the research presented in this study. The authors thank participants who kindly agreed to be interviewed for this study. Thanks also to the Agricultural Credit Corporation for facilitating this research study.