All published articles of this journal are available on ScienceDirect.

Macroeconomic Impact of Agricultural Commodity Price Volatility in Nigeria

Abstract

Introduction:

The Nigerian economy has remained consistently heavily dependent on earnings from commodity exports which constitute over 95% external earning and 85% of budgetary and fiscal financing. Agricultural commodity exports have witnessed a significant price swings in the international market in the past few decades resulting in food price hike and macroeconomic distortions in economies heavily dependent on food imports.

Methods and Materials:

The study assesses the macreoconomic impact of agricultural commodity price volatility in Nigeria from 1970-2017 using Autoregressive Distributive Lag (ARDL) cointegration and Impulse-Response Function (IRF) analysis. The study adopted an atheoretical statistics to ascertain the evidence of swings in macroeconomic aggregates.

Results:

There was evidence of persistent fluctuations in the macroeconomic variables observed, implying that external price shocks exert a significant impact on the macroeconomic management, since bulk of national budgetary and fiscal financing is from commodity exports.

Conclusion:

The study found that volatile agricultural prices were responsible for a meager 2% of macroeconomic fluctuations. The empirical evidence corroborates the statistics showing that the share of agriculture in primary commodity exports has consistently remained less than 3% since the advent of crude oil. Furthermore, the study found that the swings in agricultural prices impacts foreign reserves and inflation more significantly and earlier in the time horizons than other macroeconomic aggregates.

1. INTRODUCTION

Agricultural commodity has progressively impacted Africa’s economic development. African countries serve as suppliers of raw materials to western countries by primarily exporting crops to these countries. In the like, agriculture remains the most important single activity in Africa [1]. Agriculture is the predominant activity in SSA, employing about 60 percent of the population and serves as the livelihood for about 90 percent of the rural population. It accounts for 40 percent of Gross Domestic Product (GDP), 15 percent of its merchandise exports [2]. In this light, agriculture, therefore, remains highly important for sustainable development and poverty reduction, as well as a source for livelihood, economic growth and environmental service providers [3, 4].

In spite of the vast agriculture potentials in Nigeria, the neglect in terms of value addition in the value chain had exposed the country to substantial commodity price volatility resulting in high degree macroeconomic instability, hence negative implications for GDP per capita growth [5, 6]. Developing countries whose principal means of foreign exchange earnings come from the exports of primary commodities are plagued with unstable commodity prices which create macroeconomic instabilities and complicate macroeconomic management. A forethinking ideology by Adam Smith, David Ricardo and Thomas Malthus propagates a faster growth rate for countries endowed with natural resources than those with capital abundance. Meanwhile, the advert of the structuralist economists debugged the ideology. Prominent structuralist-Prebisch and Singer emphasized in 1950 that the price of the commodity tends to decline over time relative to those of manufactured goods-due to its higher value-addition and productivity. Therefore, commodity-exporting countries would have a disadvantage in the division of trade and be outperformed by other nations.

Trade is an important engine for economic growth, food security, poverty reduction and overall development. Also, agricultural trade is not less capable of generating growth; however, the concentrated structure of exports makes commodity-dependent countries susceptible to price shocks. For instance, Nigeria depends on commodity exports for over 96% of its foreign earnings and 80% of its budgetary financing-yielding a high degree of fiscal procyclicality. This ultimately suggests that market distortions as a result of negative price shocks will automatically distort national macroeconomic management. While exports in itself are desirable, diversification remains the central priority in developing economics. This is to ensure diversity in the dominance of traditional concentrated export basket, as whatever a country export is also critical to its economic stability. This study assesses if the cyclical movements in macroeconomic aggregates in Nigeria are strongly linked to agricultural commodity exports and suggest relevant policy options and policy buffers that could be implemented to mitigate the worsening effect of price fluctuations and strengthen macroeconomic management.

The remaining part of the paper is structured as follows: section two addresses the literature review, section three describes the atheoretical statistics connecting price fluctuations to agricultural commodity prices, section four presents the estimation procedure showing the exact magnitude of impacts and the effect of agricultural commodity price fluctuations on macroeconomic aggregates. The last part suggests useful policy recommendations and conclusions.

2. REVIEW OF RELATED LITERATURE

It has been widely established that the agricultural sector contributes to economic growth and development, hence the urge for developing countries to improve agricultural economic activities. In this section, we identify some selected empirical investigation into the role of agriculture and how commodity exports affect the macroeconomic aggregates.

Oyakhilomen and Zibah examined how agricultural production affects economic growth towards alleviating the level of poverty in Nigeria [7]. The study made use of time series data for index of agricultural production, gross domestic product, exchange rate, inflation rate and interest rate from 1970 to 2011. The Autoregressive Distributed Lag (ARDL) model was applied and the result revealed that there is a positive long-run relationship between the index of agricultural production and economic growth in Nigeria. In particular, the coefficient value showed that a percentage increase in agricultural production induces a 3.38 percent increase in economic growth in Nigeria. A similar study used ARDL to examine the contribution to food production and export in Nigeria [8], the study pointed out that technology and institutional framework are the major determinants in observing the effective performance of the agricultural sector. This is because according to a study [8] the use of modern implements in the farming process increases agricultural production which results in enhancing the exportation of agricultural commodities

Through the use of the Johansen co-integration approach, the study found similar evidence in terms of the long run relationship between agricultural production and economic growth in Nigeria [9]. This implies that the agricultural sector output is a long-run determinant of growth in Nigeria. Investigating the contribution of the agricultural sector to economic growth in Nigeria; Odetola and Etumnu made use of a growth accounting framework based on the Solow model using data from 1980 to 2011 [10]. A key contribution of the study was in the use of a weighted growth rate of the agricultural sector. The analysis indicated that over the time period, the agricultural sector positively contributed to economic growth in Nigeria. Furthermore, a Granger-Causality test was conducted to robust the findings. It was seen that there was a one-way relationship as agricultural output causes economic growth in Nigeria. The study used a panel data approach and examined how agricultural productivity leads to inclusive growth in Africa [11]. In this study, agricultural productivity was measured by agricultural value-added per worker and food productive index, while an index of inclusive growth was constructed using five indicators. Using the Generalized method of moments approach, the results pointed out that agriculture value-added significantly reduces unemployment and poverty levels in Africa, thereby concluding that an improvement in agricultural productivity is necessary for development in Africa.

Specifically looking at the role of agricultural exports on economic growth in Nigeria; the study formulated a model based on the export-led growth hypothesis and the Neo-classical growth model to investigate whether agricultural export has a long run significant impact on economic growth in Nigeria from 1980 to 2010 [12]. To achieve this objective, the Johansen maximum likelihood test for co-integration was used and the results indicated that there is indeed a long-run relationship between agricultural exports and economic growth in Nigeria. To further buttress their findings, the normalized coefficients of agricultural exports were examined and the value revealed that there is an elastic and statistically significant relationship with economic growth, such that a unit increase in agricultural commodity exports yields a more than proportionate increase in economic growth in Nigeria. Their findings corroborated [13], as the latter study found that agricultural export has a long run significant impact on economic growth in Nigeria. In addition, the coefficient value also showed an elastic relationship between the variables. However, the empirical analysis [13] exhibits a major flaw. The study disregarded a significant assumption for the use of Johansen cointegration technique, which is premised on the fact that all the variables are integrated of order one.

The study investigated the effects of agricultural exports on economic growth in Nigeria by employing Ordinary Least Squares regression (OLS), Granger-Causality tests and impulse response analysis [14]. The OLS estimates revealed that agricultural exports have a positive and statistically significant effect on economic growth in Nigeria; however, their findings were contrary to Gbaiye et al. [12]. The results showed that an inelastic relationship exists between commodity export and economic growth. The Granger-causality test showed that agricultural export causes economic growth, and economic growth also causes agricultural export, suggesting a bidirectional relationship. Lastly, the impulse response analysis provided evidence that the initial impact of shocks to agricultural export causes economic growth to decline, although it is still positive and over time it begins to increase.

3. SOME STYLIZED FACTS

3.1. Evidence of Induced Fluctuation on Macroeconomic Aggregates

Here, the study ascertains the evidence of fluctuations in macroeconomic adjustments as induced by commodity price fluctuations. In accomplishing this, the business cycle properties of the data were examined through the use of atheoretical techniques and the Hodrick-Prescott (HP) filter [5, 15, 16]. The HP filter provides the mechanism to examine three key statistical issues, such as, the measurement of the amplitude of fluctuations, contemporaneous correlation, and the phase shift.

The amplitude of fluctuations is determined from the volatility of the variable measured by the percentage change in standard deviation while the relative volatility is the ratio of the amplitude of fluctuations of a variable to usually that of total output. According to the study, a relative volatility greater than one signifies that the variable is subject to high fluctuations [17]. The contemporaneous correlation is used to ascertain whether a variable is pro-cyclical, countercyclical or acyclical. The phase shift is used to determine whether a variable is a leading or lagging indicator. To document these facts, the following macroeconomic variables were considered: Real Gross Domestic Product (RGDP), Agriculture Value-added (AGV), Household Final Consumption (HCON), Government final Expenditure (GEX), total exports (EXM) and total imports (IMP). The results are presented in Table 1 and it shows that all the variables are highly volatile as their respective relative volatility is greater than one. This suggests that these macroeconomic aggregates are subject to business cycle fluctuations induced by either domestic or external shocks. Since over 90 percent of Nigeria foreign earnings come from commodity export, the documented strong volatility in the macroeconomic aggregates must have accentuated from commodity price swings. Examining the contemporaneous correlation, agriculture value-added which served as a proxy for the level of productivity has a pro-cyclical (0.281) relationship with real gross domestic product in Nigeria. This indicates that the productivity in the agricultural sector tends to improve during periods of economic expansion or growth and vice versa. Therefore, as the Nigerian economy grows, productivity increases in the agriculture sector which then boosts the level of commodity exports.

Government expenditure is seen to be pro-cyclical in Nigeria which is against the theoretical postulations of the Keynesian theory. In the actual sense, government expenditure should exhibit a countercyclical or acyclical relationship. This is because the government is expected to increase economic activities and spend during periods of economic recession and save during periods of expansion. However, these statistics reveal otherwise for Nigeria, although it is not surprising as Alege and Adu obtained similar findings for Nigeria [17, 18]. This reflects that the government is heavily involved in economic activities in the country. Furthermore, the cyclical component is seen to be a leading indicator of the economy. Household consumption is also pro-cyclical, but a lagging indicator in Nigeria, insinuating that individuals usually respond or change their consumption pattern in tandem to macroeconomic events or changes in the economy.

| Variables | Statistics |

|---|---|

| Real GDP (RGDP) Volatility | 5.757% |

| Agricultural Value Added (AGV) | Pro-cyclical |

| Contemporaneous correlation Volatility Relative Volatility Phase Shift |

0.281 6.871% 1.194 Lagging |

| Household final consumption (HCON) | Pro-cyclical |

| Contemporaneous correlation Volatility Relative Volatility Phase Shift |

0.692 9.756% 1.694 Lagging |

| Government expenditure (GEX) | Pro-cyclical |

| Contemporaneous correlation Volatility Relative Volatility Phase Shift |

0.683 31.87% 5.536 Leading |

| Total Exports (EXM) | Pro-cyclical |

| Contemporaneous correlation Volatility Relative Volatility Phase Shift |

0.310 14.14% 2.465 Leading |

| Total Imports (IMP) | Pro-cyclical |

| Contemporaneous correlation Volatility Relative Volatility Phase Shift |

0.454 24.71% 4.293 Leading |

Total exports and imports both exhibit a pro-cyclical relationship with real gross domestic output in Nigeria. The findings of Ogundipe corroborate our findings [5], implying that the exports of goods and services tend to rise as total output in the economy is rising. This is because firms are able to produce more goods and services for export as demand expands. Imports, on the other hand, contradict expectations as one would expect the level of imports to decline as the economy grows. However, the finding is not surprising for a developing economy like Nigeria that imports the bulk of what is consumed [17, 19].

The foregoing illustrates significant variations in the macroeconomic aggregates, implying that shocks arising from foreign earnings (commodity price fluctuation) have a significant impact on macroeconomic management in the Nigeria economy. This evidence portrays the present reality in the Nigerian economy, as it is heavily dependent on commodity export – frequently characterized by incessant price swings. In most times, economy planning has been hampered due to strong inelastic price and demand for commodities in the international market. It hence becomes expedient for commodity-dependent nation (like Nigeria) to understand the nature and strength of commodity price dynamism in order to ensure proper economic planning, that is void of macroeconomic distortions. In addition, since diversification is a long term agenda, the study identifies possible structural buffers capable of mitigating the negative impact of sudden price swings. This is relevant for agricultural commodity-exporting countries to set appropriate structural economic policies and appropriate economic gains for sustainable economic development.

4. DATA AND METHODOLOGY

4.1. Data Trends, Sources and Measurement

The section shows data representation of the link between agricultural commodity price volatility and cycles in the macroeconomic variables in Nigeria. There has been an overwhelming evidences on the incessant fluctuations and distortions in the macroeconomics of developing economies, especially those whose principal means of earnings come from the export of primary commodities. These commodities are mostly associated with major swings in price, hence making planning difficult and creating macroeconomic instabilities which often complicate macroeconomic management. Asides crude oil, agricultural products constitute Nigerian largest commodity exports, which makes agricultural commodity price volatility capable of stimulating macroeconomic dynamism in Nigeria.

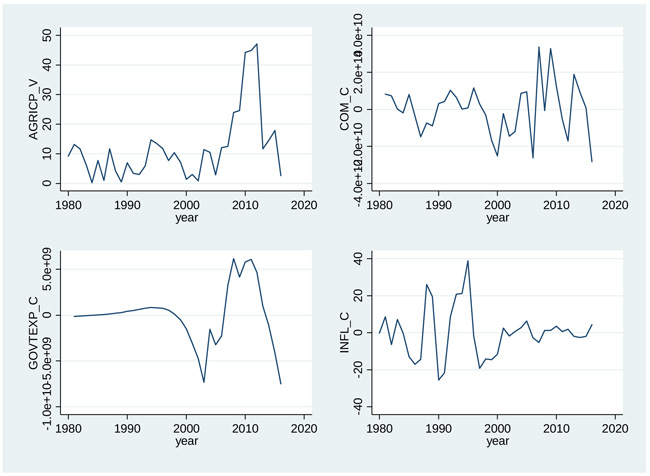

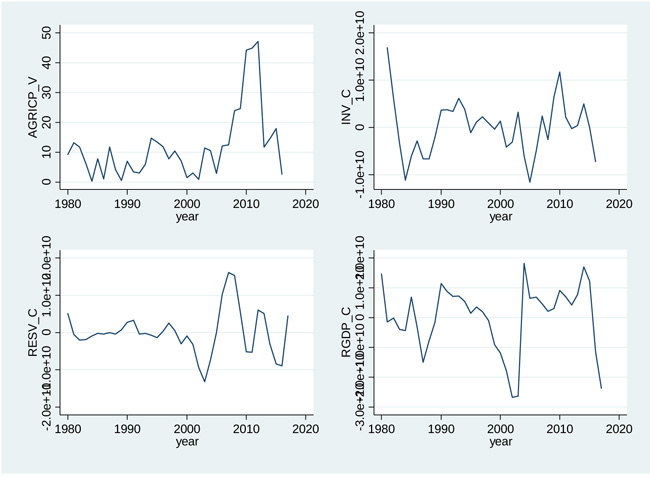

Figs. (1a & b) illustrates the trend between agricultural commodity price volatility and the cyclical movement of macroeoconomic aggregates from 1980 to 2017. The period observed shows an incessant movement in the macroaggregates. A close observation shows that there is inconsistent alignment between agricultural commodity price volatility and the macroeconomic aggregates for the period 1980-2005. Subsequently, from 2006 upwards, the volatile agricultural commodity prices seem reflective in the macroeconomic aggregates; this is particularly glaring for consumption expenditure, government expenditure, foreign reserves, gross domestic product and domestic investment. The erstwhile weak link can be attributed to the large dominance of crude oil exports in the Nigerian commodity export volume. For instance, of the 98% and 97% share of primary commodity exports in all merchandise exports, agricultural commodity export constitute only a meager 0.45% and 0.5% in 2000 and 2010, respectively. Also, for the period 1995-2015, the share of agriculture in primary commodities never exceeded a maximum of 2.45% and a minimum of 0.32% in 1995 and 2004, respectively.

Source: Compiled by authors using Stata.

Source: Complied by authors using Stata.

In Fig. (2), the year 2007, shows a gradual increase in the share of agricultural commodity export in total primary commodity exports while the period also witnessed a decline in primary export commodities. This could not have been unconnected with the unrest in oil producing areas which limited exploration and quantity of barrels exportable per day. The evidence from the correlation matrix in Table 2 seems consistent with assertions from the line trend, suggesting on the average, a weak correlation between agricultural commodity price volatility and macroeconomic aggregates. The agricultural commodity price volatility is not correlated with cycles in foreign reserves, and weakly correlated with cycles in domestic investment and GDP. On the other hand, the cyclical movement in government consumption significantly correlates with agricultural commodity price volatility. This again reflects the weak foreign earnings from agricultural commodity exports when compared to total primary community exports Table (3).

| Variable | agricp_v | Coms_c | Govt _c | Infl_c | Inv_c | Resv_c | Rgdp_c |

|---|---|---|---|---|---|---|---|

| agricp_v | 1.0000 | - | - | - | - | - | - |

| Coms_c | 0.1328 | 1.0000 | - | - | - | - | - |

| 0.4400 | - | - | - | - | - | - | |

| Govtexp_c | 0.6391*** | 0.4293*** | 1.0000 | - | - | - | - |

| 0.0000 | 0.0090 | - | - | - | - | - | |

| Infl_c | 0.0711 | 0.0395 | 0.0328 | 1.0000 | - | - | - |

| 0.6757 | 0.8193 | 0.8494 | - | - | - | - | |

| Inv_c | 0.3809** | 0.3818** | 0.3376** | -0.0152 | 1.0000 | - | - |

| 0.0219 | 0.0216 | 0.0441 | 0.9298 | - | - | - | |

| Resv_c | 0.1124 | 0.3149* | 0.5882*** | -0.1214 | 0.0233 | 1.0000 | - |

| 0.5078 | 0.0614 | 0.0002 | 0.4740 | 0.8929 | - | - | |

| Rgdp_c | 0.3116* | 0.5233*** | 0.4638*** | -0.0028 | 0.2241 | 0.2888* | 1.0000 |

| 0.0604 | 0.0011 | 0.0044 | 0.9867 | 0.1888 | 0.0787 | - |

Source:Complied by authors using Stata.

| Variable | Description | Measurement | Source |

|---|---|---|---|

| RGDP | Gross Domestic Product | Constant 2010 US$ | World Development Indicators of World Bank Publication (2017) |

| GXD | General government consumption expenditure | Constant 2010 US$ | WDI |

| RESV | Total Reserves | Current 2010 US$ | WDI |

| K | Gross fixed capital formation | Constant 2010 US$ | WDI |

| INV | Gross capital formation | Constant 2010 US$ | WDI |

| COMS | Final Consumption expenditure | Constant 2010 US$ | WDI |

| INFL | Inflation, consumer prices | Percentage | WDI |

| L | Labour force | Number | WDI |

| FDEPT | Domestic Credit to private sector | percentage | WDI |

| EDU | Secondary School Enrolment | percentage | WDI |

| INST | Average of the six indicators including: control of corruption, government effectiveness, political stability and absence of violence & terrorism, regulatory quality, rule of law and voice and accountability | scale | World Governance Inductor of World Bank Publication (2017) |

| AGRICP | International market price of Agricultural products | Index | UNCTAD |

| Agricp_vol | Agricultural price volatility | generated | Standard deviation of the growth rate of agricultural price. |

4.2. Model Specification

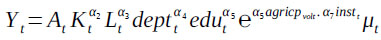

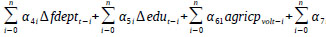

The study describes empirically the connection between agricultural commodity price volatility and macroeconomic aggregates in Nigeria. The study adopts two approaches; first is to assess the contemporaneous effect of agricultural commodity price on economic growth. On the other hand, the second approach considers the impact of agricultural commodity prices on macroeconomic aggregates, such as consumption, foreign reverses, government expenditure, gross domestic product and domestic investment. In addressing the first objective, the study adopts an abridged version of the Solow production function previously used in extant studies [5, 20-22]. This is illustrated thus:

|

Where Yt is the output per capita, A is total factor productivity, K is the stock of capital, L is labour force, α and β are the elasticities, e is exponential function, γ is a series comprising some negative integers, X is a vector of other explanatory variables that are necessary in the growth function such as the strength of financial intermediation.

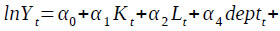

The model is represented as:

|

In order to estimate the above model using the classical linear regression approach, there is need to ensure the model is linear in variables. Hence, we log linearised by taking double log of the model, the above equation becomes:

|

Where At = α0, vt = lnut, t is the time identifier, dept is the financial depth, edu is education, agricpvol is the agricultural export price volatility and inst is institutions. The apriori expectation is indicated thus: α1, α2, α3, α4, α5>0 and α6, can assume either positive or negative value.

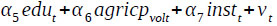

4.3. Technique of Estimation

The study adopts the ARDL co-integration technique developed by and Shin and Pesaran et al. for assessing the relationship between economic growth and agricultural export price volatility [23, 24]. This approach is preferable when the strict assumption of I(0) integration is not achievable for all the variables. Cointegration is a procedure of obtaining a steady equilibrium among variables, it overcomes the issue of non-stationarity and prior restrictions on the lag structure of models. Other commonly used cointegration approaches in applied econometrics include: The step procedure [25, 26] and the Johansen Cointegration technique [27]. The procedure gained popularity in ascertaining long-run relationship between series that are non-stationary and enables re-parameterizing the series to obtain the Error Correction Model (ECM). The two-step procedure has been heavily criticized due to its inability to obtain the long run estimates. Similarly, unlike the Johansen framework, the ARDL does not require that all variables be stationary at order 1 but applicable for a combination of I(0) and I(1) variables.

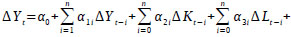

An ARDL structure of the equation above is as follow:

|

Where ∆ denotes the difference (first) operator, a0 is the drift component, and et is the random error term. The equation above constitutes both the long-run relationship and short run dynamics. The expressions constituting β1 – β7 is the long run equation, while those with α1 – α2 is the short run dynamics.

The ARDL bound test is based on the wald test (F-statistic). According to the study, cointegration test produces two critical values – lower critical bound and upper critical bound [24]. The lower critical bound takes all series as I(0), hence no evidence of cointegrating relationship. The upper critical bound assumes the series are I(1) suggesting that cointegration exists among the series. A decision is reached using the computed F-statistics, if it is greater than the upper bound critical values, then the null hypothesis is rejected, hence cointegration exists. If the F-statistic is below the lower bound critical values, then the null hypothesis cannot be rejected, hence, there is no cointegration. However, when the computed F-statistic lies between the lower and upper critical bond, the result becomes inconclusive.

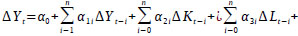

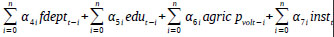

As evident in this study, the ARDL can be applied for a small sample size. It can be applied without the burden of establishing the order of integration of series. However, in order to be certain that none of the variables is integrated at order high than one, one can still proceed with the unit root test. The equation above can be expressed in the ARDL form of the error correction as:

|

Where, λ is the speed of adjustment parameter and EC is the residuals that are obtained from the estimated co-integration model.

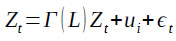

Subsequently, the study adopts the vector autoregressive approach in estimating the impact of agricultural commodity prices on macroeconomic aggregates in Nigeria. The econometric model takes the following reduced form:

|

Where Zit is a vector of stationary variables such that

|

Here, RGDP is the real GDP growth, INV is investment, GXP is government spending, RESV is foreign reserves, COMS is government consumption expenditure, INF is inflation rate, Г(L) is a matrix polynomial in the lag operator with Г(L) = Г2L2 + Г2L2 + …+ ГpLpϵt is a vector of idiosyncratic errors. In its actual sense, we are not interested in the coefficients of the VAR, we then proceed to compute the Impulse Response Functions (IRFs) and the Variance Decomposition (VDCs). The impulse response functions describe the response of an endogenous variable overtime to a shock on another variable in the system, while the variance decomposition measures the contributions of each source of shock to the variance of each endogenous variable at a given forecast horizon.

5. ECONOMETRIC ANALYSIS AND RESULT DISCUSSION

Table 4 shows the pairwise correlation coefficients among the explanatory variables. This pre-estimation assessment is required to ascertain the likelihood of linear dependence among the explanatory variables. The highest coefficient being 0.81 exists between education and labour force (Table 4). This is evidently premised on the fact that a greater share of those enrolled in higher learning institutions constitutes a subset of the labour force. Generally, the result shows no serious problem of multicollinearity, as there is no perfect linear dependence among the explanatory variables. The variables in the model can be combined and parameters can be obtained without any ambiguity, hence, yielding an empirical model capable of making inferences and prediction.

Table 5 shows the summary statistics of the variables in the model. The statistics described for the variables include: the mean, median, maximum, minimum and measures of residual normality (skewness, kurtosis, Jarque-bera). Agricultural price volatility shows some level of amplitude of fluctuations with a maximum of 46.99, a mean of 9.23 and a minimum of 0.076. The wide difference between the maximum and the mean reflects strong swings over the period. Also, the average amplitude of fluctuation of 9.23 reveals an evidence of incessant fluctuations in agriculture price. Theoretically, the amplitude of fluctuation greater than one indicates the persistence of fluctuation (volatility), hence, the agricultural price has been intently volatile for the period observed. Also, the result shows a progressive gain in GDP in the economy as reflective in the wide divergence between the minimum and the mean value. The upward surge in the GDP value shows increased economic activities and expansion in size of the Nigerian economy. The evidence is similar for capital stock; the rising trend was observed considering the minimum, average and the maximum value. In the same vein, the labour force has risen considerably from a minimum of about 29 million to a maximum of 59 million and an average for the period being 35.7 million. Furthermore, school enrolment (education) witnessed an upward trend from a minimum of 4.43 to a maximum of 56.16 and an average value of 22.94.

Table 6 shows the result of unit root test. This is required to assess the stationarity or time series property of the variables used in the model. The test is premised on the fact that economic variables exhibit non-stationary pattern over time, in the sense that values attained by their mean and variances are not independent of time, that is, it possesses a unit root. The unit root tests adopted in the study are namely: the Augmented Dickey-Fuller and the Philip Perron test. The null hypothesis of the existence of unit root could not be rejected for all variables at the level form except for labour force and financial depth. However, the unit root process in the other variables was purged at the first-order differencing, hence, the null hypothesis of the existence of unit root was rejected. From the foregoing, the series in the model were a combination of I(0) and I(1) order of integration.

Following the combination of I(0) and I(1) stationary series, the ARDL co-integration analysis is preferred due to its ability to handle the determination of long-run relationship with combined I(0) and I(1) series. The best model was attained using automatic lag selection based on Akaike Information Criterion (AIC). The bound test indicates an evidence of co-integration at 10% significance level. At this point, the bound test F-statistics (3.6615) was greater than the upper bound value (3.59) implying the rejection of the null hypothesis of no co-integration at 10% significance level (Table 7). This evidence suggests the presence of long-run co-integrating relationship among the variables in the model.

| Variable | GFCF | LAB | FDEPT | EDU | AGRICP_V | INST |

|---|---|---|---|---|---|---|

| GFCF | 1 | 0.184575 | -0.21745 | -0.18361 | 0.176272 | -0.13419 |

| LAB | 0.184575 | 1 | 0.470457 | 0.870627 | 0.576471 | -0.85558 |

| FDEPT | -0.21745 | 0.470457 | 1 | 0.572177 | 0.364335 | -0.41348 |

| EDU | -0.18361 | 0.870627 | 0.572177 | 1 | 0.52162 | -0.73819 |

| AGRICP_V | 0.176272 | 0.576471 | 0.364335 | 0.52162 | 1 | -0.48342 |

| INST | -0.13419 | -0.85558 | -0.41348 | -0.73819 | -0.48342 | 1 |

| - | RGDP | GFCF | LAB | FDEPT | EDU | AGRICP_V | INST |

|---|---|---|---|---|---|---|---|

| Mean | 1.77E+11 | 4.10E+10 | 35760547 | 12.1383 | 22.9377 | 9.228164 | -1.09367 |

| Median | 1.31E+11 | 5.61E+10 | 29591445 | 12.33386 | 24.24702 | 5.995676 | -1.03408 |

| Maximum | 4.64E+11 | 7.03E+10 | 58958901 | 38.38656 | 56.17987 | 46.99903 | -0.95324 |

| Minimum | 5.83E+10 | 1.20E+10 | 29591445 | 3.696699 | 4.43323 | 0.076603 | -1.35185 |

| Std. Dev. | 1.19E+11 | 2.07E+10 | 8852315 | 6.316215 | 15.98156 | 10.69689 | 0.104649 |

| Skewness | 1.300458 | -0.23883 | 1.228183 | 1.911451 | 0.557611 | 2.109584 | -1.24569 |

| Kurtosis | 3.388617 | 1.248533 | 3.182472 | 8.511076 | 2.491915 | 7.577731 | 3.037967 |

| Jarque-Bera | 16.71315 | 7.827535 | 14.662 | 108.7175 | 3.566943 | 90.43302 | 13.9689 |

| Probability | 0.000235 | 0.019965 | 0.000655 | 0 | 0.168054 | 0 | 0.000926 |

| Observations | 58 | 57 | 58 | 58 | 57 | 56 | 54 |

| Series | ADF | PP | Order of Integration | ||||

|---|---|---|---|---|---|---|---|

| Level | First Diff. | Level | First Diff. | ||||

| Rgdp | 2.301 | -4.032*** | 1.639 | -3.990* | I(1) | ||

| Gfcf | -0.641 | -3.748*** | -1.201 | -3.944 | I(1) | ||

| Lab | 24.872*** | 1.239 | 20.644*** | 1.603 | I(0) | ||

| Fdept | -2.845* | -5.491*** | -2.621* | -10.131*** | I(0) | ||

| Edu | 0.439 | -4.729*** | 0.232 | -3.397*** | I(1) | ||

| Agricp_v | -2.342 | -6.660*** | -0.312 | -6.658*** | I(1) | ||

| Inst | -1.708 | -16.217*** | -4.043*** | -17.096*** | I(1) | ||

| Test Critical Values: | |||||||

| - | Level | First Diff. | |||||

| 1 per cent | -3.6210 | -3.6268 | |||||

| 5 per cent | -2.9434 | -2.9458 | |||||

| 10 per cent | -2.6102 | -2.6115 | |||||

| Dependent Variable: lnrgdp (ARDL 4, 4, 3, 4, 3, 4, 3) | |||||

|---|---|---|---|---|---|

| Independent Variables: | |||||

| Significance | Critical Value Bounds | K | F-Statistics | Evaluation of Hypothesis | |

| IO Bound | I1 Bound | ||||

| 10 percent | 2.53 | 3.59 | 6 | 3.6615 | Cointegration |

| 5 percent | 2.87 | 4 | 6 | 3.6615 | No cointegration |

| 2.5 percent | 3.19 | 4.38 | 6 | 3.6615 | No cointegration |

| 1 percent | 3.6 | 4.9 | 6 | 3.6615 | No cointegration |

Having obtained the evidence of long-run co-integration with the bound test, the study proceeds to estimate the long-run and short-run estimates (Table 8). The evidence from the result shows that GDP responds inversely to changes in agricultural price volatility. Specifically, a unit change in agricultural price volatility reduces growth by 0.022 units, implying that growth responded less proportionately to changes in agricultural price volatility. The evidence could have resulted from the declining share of agriculture in foreign income earning and GDP growth. However, the share of agriculture later has witnessed a slight increase due to recent advocacy and policy awakening in support of agricultural development. This evidence hence suggests that agricultural price volatility hampers growth, though; the effect is marginal for the period observed. It thus implies that the large amplitude witnessed in GDP and macroeconomic aggregates in the economy which is linked to swings in the international prices of commodities must have accentuated largely from other commodity exports. For instance, crude oil is prominent export commodity, accounting for a larger share of the economy's foreign earnings. Though, agriculture exports also represent an important constituent of the commodity export basket, however, the empirical evidence reveals that the incessant fluctuations in the agricultural commodity prices accounts for about 2% of the resulting macroeconomic distortion experienced in the Nigerian economy.

| Department Variable: LNRGDP | ||||

|---|---|---|---|---|

| Long-Run Relationship | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| Lngfcf | 0.1529 | 0.0208 | 7.3510 | 0.0414 |

| Lnlab | 0.4258 | 0.1951 | 2.1825 | 0.0267 |

| Lnfdept | 0.1206 | 0.0179 | 6.7374 | 0.0362 |

| Lnedu | 0.2538 | 0.0697 | 3.6413 | 0.0395 |

| Agricp_v | -0.0218 | 0.0063 | -3.4603 | 0.0084 |

| inst | -3.5941 | 1.0652 | -3.3741 | 0.0102 |

| C | 1.0213 | 0.2123 | 4.8106 | 0.0192 |

| Short-Run Relationship | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| D(LNRGDP(-1)) | 1.0209 | 0.5285 | 1.9315 | 0.0895 |

| D(LNRGDP(-2)) | 0.6821 | 0.4637 | 1.4711 | 0.1795 |

| D(LNRGDP(-3)) | 0.5076 | 0.4462 | 1.1377 | 0.2882 |

| D(LNGFCF) | 0.2870 | 0.0963 | 2.9797 | 0.0176 |

| D(LNGFCF(-1)) | 0.0147 | 0.2049 | 0.07173 | 0.9446 |

| D(LNGFCF(-2)) | -0.0487 | 0.1794 | -0.2714 | 0.7929 |

| D(LNGFCF(-3)) | -0.1667 | 0.1178 | -1.4158 | 0.1946 |

| D(LNLAB) | -3.8512 | 2.4457 | -1.5747 | 0.1540 |

| D(LNLAB(-1)) | 13.3036 | 5.9807 | 2.2244 | 0.0568 |

| D(LNLAB(-2)) | -8.4026 | 4.2980 | -1.9550 | 0.0863 |

| D(LNFDEPT) | -0.1171 | 0.0421 | -2.7837 | 0.0238 |

| D(LNFDEPT(-1)) | -0.1496 | 0.1024 | -1.4601 | 0.1824 |

| D(LNFDEPT(-2)) | 0.0684 | 0.0802 | 0.8535 | 0.4182 |

| D(LNFDEPT(-3)) | 0.2901 | 0.1029 | 2.8189 | 0.0225 |

| D(LNEDU) | -0.2147 | 0.2326 | -0.9230 | 0.3830 |

| D(LNEDU(-1)) | -0.0681 | 0.3994 | -0.1707 | 0.8687 |

| D(LNEDU(-2)) | 0.3226 | 0.3067 | 1.0517 | 0.3236 |

| D(AGRICP_V(-1)) | -0.0038 | 0.0029 | -1.3185 | 0.2238 |

| D(AGRICP_V(-2)) | -0.0091 | 0.0027 | -3.3841 | 0.0096 |

| D(AGRICP_V(-3)) | -0.0060 | 0.0050 | -1.2091 | 0.2611 |

| D(INST) | 1.1651 | 0.6523 | 1.7862 | 0.1119 |

| D(INST(-1)) | 3.0830 | 0.8989 | 3.4295 | 0.0090 |

| D(INST(-2)) | 1.5868 | 0.4128 | 3.8436 | 0.0049 |

| D(INST(-3)) | 1.4124 | 0.2657 | 5.3164 | 0.0007 |

| ECM | -0.3731 | 0.3229 | -3.9429 | 0.0043 |

The indicator of capital stock varies directly with economic growth; that is, GDP responds significantly and positively to changes in capital stock. Specifically, a 100% change in capital stock results in about 15.3% changes in economic growth; implying that GDP responds less proportionately to changes in capital stock. This evidence suggests that increasing capital stock in terms of physical assets, investment growth and resources results in the increased economic outlook. This implies that increasing assets and resources serve as capital for driving productiveness and competitiveness, which in turn, raises income and growth. This evidence was similar for labour force, financial depth and education. Specifically, a 100% change in labour force, financial depth and education yield about 42.6%, 12.1% and 25.4% change in economic growth, respectively. However, the indicator of labour force exerts a higher influence on GDP, mainly due to the relatively higher labour intensiveness in the Nigerian economy. Finally, the institutions impact the GDP negatively, implying that the institutions arrangement in Nigeria hampers the growth process. This is evident in the relatively weak institutions in Nigeria and this has arguably responsible for several socio-economic impediments towards attaining sustainable development.

The short-run vector error correction model was estimated to obtain the error mechanism. The model assesses the strength of the long-run converging relationship in the model. The estimation of VEC model is premised on the existence of co-integrating relationship. To ascertain a feasible long-run convergence, the error correction mechanism – which is the factor responsible for correcting short-run disequilibria, must exhibit three prominent features including: 1. The coefficient must be negative, 2. The absolute value must lie between 0 and 1, and 3. It must be statistically significant. For this study, evidence from the lower panel in Table 8 shows that the ECM statistic satisfies the three criteria; hence long-run convergence was attained. The ECM statistic implies that 37.3% of errors in the current period are corrected in the immediate period as the model approaches the long-run equilibrium path.

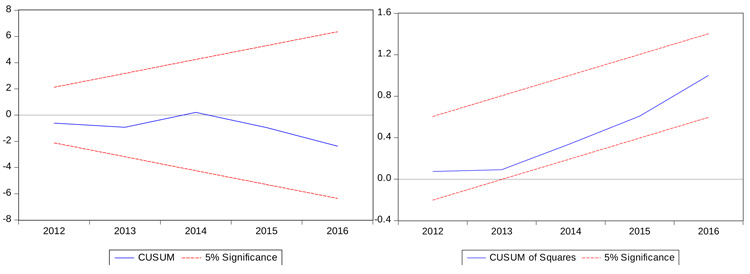

The post estimation tests conducted include: the autocorrelation test, heteroskedasticity test and residual normality test. The tests were conducted to ascertain the reliability of parameter estimates. The evidence from Table 9 shows that the null hypothesis of no autocorrelation, no heteroskedasticity and residual normality could not be rejected, hence, suggesting reliability of the estimates for drawing inferences and making predictions. In the same manner, the long-run stability of the model coefficients was tested using the cumulative sum and the cumulative sum of square line, the two lines fall within the 5% significance region (Figs. 3a & 3b) implying that the coefficient is considered stable as the model approaches the long-run equilibrium path.

The IRFs shows the response of variables observed to external changes to agricultural commodity prices. Fig. (4) shows accumulated responses of the macroeconomic variables to one standard deviation shock in agriculture price. The evidence shows that a one standard deviation shock to agriculture prices inversely impact the macroeconomic aggregates as the time horizon expands. The adverse effect was prompt on reserves and inflation. In the initial period, RGDP, private consumption expenditure, government expenditure and investment exhibit an upward trend in response to shocks in agricultural prices until the 9th horizon when a declining trend set-in. However, the adverse effect of agricultural price shock was prompt on reserves and inflation. The varying impact was due to the effect of stabilization measures of the economy whose direct effects are feasible on reserves, then followed by consumer prices. In cases of negative shocks on foreign earnings resulting from volatile commodity prices, the economy defends pressure on its currency and macroeconomic stand by depleting reserves. If the adverse effect progresses, these pressures are transmitted to prices, especially for net importing economies and subsequently, the impact becomes feasible on other macroeconomic aggregates.

Table 9.

| Dependent Variable: lnrgdp (ARDL 4, 4, 3, 4, 3, 4, 3) | ||

|---|---|---|

| Breusch-Godfrey Serial Correlation LM Test | Obs.*R-Squared value | 35.8829 |

| Chi-Square (4) Prob. value | 0.4511 | |

| Breusch-Pagan-Godfrey Heteroskedasticity test | Obs*R-squared | 35.4021 |

| Chi-Square(33) Prob. value | 0.3555 | |

| Heteroskedasticity Test: ARCH | Obs.*R-Squared value | 5.3838 |

| Chi-Square (1) Prob. value | 0.0903 | |

| Histogram Normality Test | Jarque Bera value | 6.8731 |

| Prob. value | 0.0562 | |

Source: Authors’ Computation.

CONCLUSION

The structuralist economists are prominent in emphasizing the challenges of commodity-led growth, as the price of commodities tends to decline over time relative to the manufactures due to weak income and supply elasticities. Developing countries whose principal means of foreign exchange earnings come from the exports of primary commodities are plagued with unstable commodity prices which create macroeconomic instabilities and complicate macroeconomic management. The study investigates the response magnitude of GDP to changes in agricultural commodity price volatility; it equally assesses the response of macroeconomic aggregates to shocks in agricultural commodity prices. The study based its theoretical strand on structuralist approach and adopted an abridged version of Solow production function. The objective investigating theresponse magnitude on GDP was accomplished using ARDL co-integration approach due to the evidence supporting the combination of I(0) and I(1) stationary series. On the other hand, the second objective was accomplished using an out-of-sample Impulse Response Function.

Source: Authors’ Computation.

The study adopted an atheoretical statistics to ascertain an evidence of swings in macroeconomic aggregates. There was evidence of persistent fluctuations in the macroeconomic variables observed, implying that external price shocks exert a significant impact on macroeconomic management, since the bulk of national budgetary and fiscal financing is from commodity exports. However, the study found that volatile agricultural prices were responsible for a meagre 2% of macroeconomic fluctuations. The empirical evidence corroborates the statistics showing that the share of agricultures in primary commodity exports has consistently remained less than 3% since the advent of crude oil. Furthermore, the study found that swings in agricultural prices impact foreign reserves and inflation more significantly and earlier in the time horizons than other macroeconomic aggregates. Though evidence from the foregoing reveals that macroeconomic distortions arising from agricultural commodity price volatility are quite minimal, however, the policy makers need to embark on developing an import substitution framework for consumer goods and internalize the benefits of value addition that is currently been transferred abroad via commodity exports. This serves double benefits; first, attracting more foreign income from exports of processed consumer goods which commands higher price than commodities and second, it serves as an hedge against shocks from swings in prices which raises import bills and worsens the welfare.

ETHICS APPROVAL AND CONSENT TO PARTICIPATE

Not applicable.

HUMAN AND ANIMAL RIGHTS

No animals/humans were used for studies that are the basis of this research.

CONSENT FOR PUBLICATION

Not applicable.

AVAILABILITY OF DATA AND MATERIALS

Not applicable.

FUNDING

None.

CONFLICT OF INTEREST

The authors declare no conflict of interest, financial or otherwise.

ACKNOWLEDGEMENTS

Declared none.